Discounts could be even more plentiful than usual this holiday season for regional shoppers as retailers look to draw down their massive inventory, the result of a frenetic few years at the New York-New Jersey gateway and other ports around the nation.

Santa is putting his elves to work earlier than ever this year.

While the so-called “Christmas creep” phenomenon is an annual topic of debate, this year shoppers may find ample opportunity for ahead-of-schedule holiday shopping with discounts galore. Retailers are predicting an even earlier-than-usual start to the holiday shopping season, at least partially thanks to the unusual shipping trends of the past few years seen at cargo gateways such as the Port of New York and New Jersey leading to some jam-packed warehouses and excess inventory. As a result, retailers may be willing to give deep discounts to see those items finally leave their warehouses.

“The numbers show us that many warehouses are bursting at the seams, and they have been for a while,” said Bethann Rooney, port director at the Port Authority of New York and New Jersey. “That means stores are going to do all they can to make some space, and that includes slashing prices.”

The abundance of goods can be traced back to mid-2020, when the floodgates opened following an initial pandemic slowdown. Cargo continued flowing at unprecedented rates through late 2022 as retailers looked to meet an ever-growing demand among stuck-at-home consumers for new furniture, clothing, and household appliances. Wholesalers also had concerns about overseas production, ordering goods as fast as they could in the hopes of surviving any pandemic-related manufacturing halts, particularly in China.

That multifaceted panic buying at the retail level led to record activity at U.S. seaports during the past two years. In 2022, the Port of New York and New Jersey handled 9.5 million TEUs (twenty-foot equivalent units), 20 percent more than what went through the port in pre-pandemic 2019.

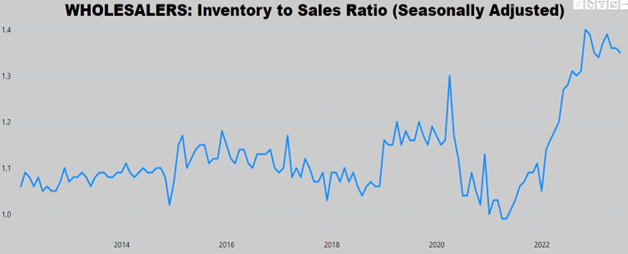

By the time the cargo dust settled in 2023, pandemic concerns were winding down and consumers were back to spending on experiences like vacations and concerts rather than on goods such as appliances and clothes. That left warehouse shelves overstocked and retailers full of excess product, driving up an industry statistic known as the inventory-to-sales ratio to its highest levels in over a decade among some products.

“Companies want to match their product inventories with that product’s demand to keep their operations efficient and cost-effective,” Rooney explained. “When those numbers don’t match up, that’s when we see them taking a look at drastic measures to get goods moving again.”

That ratio shift may be most pronounced among household appliances and electronics. After a decade when the inventory to sales ratio hovered between 1.1 and 1.2 – meaning inventories were closely matched with demand – during early 2022, the ratio jumped to nearly 1.4, a sign that everything from phones and laptops to refrigerators and televisions were moving off shelves slower than retailers were expecting. As a result, those items could be among this season’s most deeply discounted products.

A similar trend is underway with clothing and apparel. Its ratio has traditionally been locked around 2. But since the beginning of last year, the number jumped to 3 and has remained there since, indicating warehouses are stuffed with shirts, sweaters, pants and socks.

Beyond those expected discounts, the merchandise mismatch comes with an additional silver lining: helping to blunt the impact of the Panama Canal’s months-long water drought. Despite a severe drought limiting the number of ships that can pass through the canal, Rooney said the Port of New York and New Jersey has seen minimal impact on cargo volumes.

“Only about a quarter of the ships that arrive here have gone through the Panama Canal on their way over,” she noted. “Combine that with cargo levels getting back to normal and retailers looking to draw down what they already have in their warehouses, and we’re not anticipating any big concerns for the time being.” Even if much of what’s on sale this holiday season was the result of the record cargo traffic seen in 2021 and 2022, the port has been very active in 2023. The usual peak season arrived on schedule during mid-summer, traditionally when retailers must receive shipments to get items to shelves in time for holiday shopping. The Port of New York and New Jersey moved 725,479 TEUs in July, making it the busiest seaport in the nation for the month.

Through July, dockworkers were busy hauling containers filled with wintry holiday décor, shipments of which jumped 151 percent from June as retailers anticipate homes and offices going all out on decorations this holiday season. Other hot holiday gifts may include perfumes, which saw a 40 percent increase in shipments in July, and wheeled toys, including toy cars, scooters, and tricycles, the shipments for which grew by 34 percent. Sporting equipment and cold-weather clothing that came through the port will also be popular sales items around the region.

Still, this holiday shopping season may be best defined by the anxious economic activity that started back in 2020, Rooney said. “We’re still feeling the effects of the wild last few years in the global shipping world,” Rooney said. “But if you’re looking for a discount this holiday season, it could be the gift that keeps on giving.”